Get the free roundpoint mortgage payoff

Show details

PAYOFF REQUEST FORM I We / authorize RoundPoint Mortgage Servicing Corporation to provide a payoff quote to representing the amount required to satisfy my our loan in full. Loan Number Borrower Name Last four digits of SSN Payoff Good Through Date Property Address Signature s Borrower Home Equity Lines of Credit Only Upon payment of my our loan in full please close the line of credit and release the lien. Borrower s Signature Co-Borrower s Signature Please provide instructions to return...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign roundpoint mortgage servicing payoff request form

Edit your roundpoint mortgage payoff request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roundpoint mortgage payoff request online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payoffrequest roundpointmortgage com online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit roundpoint payoff form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roundpoint request form

How to fill out NC RoundPoint Mortgage Payoff Request Form

01

Obtain the NC RoundPoint Mortgage Payoff Request Form from the RoundPoint website or your loan officer.

02

Fill in your personal information, including your full name, address, and loan number.

03

Specify the desired payoff date in the appropriate section of the form.

04

Include any pertinent information that might assist RoundPoint in processing your request, such as contact details.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form via email, fax, or mail as per the instructions provided by RoundPoint.

Who needs NC RoundPoint Mortgage Payoff Request Form?

01

Homeowners who have a mortgage with RoundPoint and wish to pay off their loan.

02

Individuals seeking to obtain a payoff statement for their mortgage.

03

Real estate professionals assisting clients in closing property transactions involving a RoundPoint loan.

Fill

roundpoint servicing request

: Try Risk Free

People Also Ask about roundpoint mortgage request

How do I request a payoff request?

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How long does it take to get a payoff request?

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

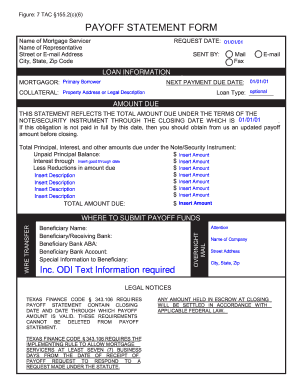

What is a request for payoff balance?

A payoff request is a statement prepared by your lender which details the payoff amount for prepayment of your mortgage loan. The payoff statement will typically be the remaining balance on your mortgage loan, but it might also include any accrued interest or late charges/fees that could be owed.

What happens when you request a payoff quote?

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

What is the phone number for Roundpoint Mortgage payoff request?

Call 877.426.8805 to make a one-time payment or set up recurring payments with one of our customer service representatives.

What does it mean to request a payoff amount?

Your payoff amount is how much you will actually have to pay to satisfy the terms of your mortgage loan and completely pay off your debt. Your payoff amount is different from your current balance. Your current balance might not reflect how much you actually have to pay to completely satisfy the loan.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit roundpoint payoff request from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your roundpoint mortgage payoff phone number into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send roundpoint request for eSignature?

When you're ready to share your mortgage online, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my roundpoint mortgage payoff statement in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your roundpoint mortgage payoff request phone number and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is NC RoundPoint Mortgage Payoff Request Form?

The NC RoundPoint Mortgage Payoff Request Form is a document used by borrowers to formally request the payoff amount owed on their mortgage from RoundPoint Mortgage.

Who is required to file NC RoundPoint Mortgage Payoff Request Form?

The borrower or their authorized representative is required to file the NC RoundPoint Mortgage Payoff Request Form to obtain the payoff information.

How to fill out NC RoundPoint Mortgage Payoff Request Form?

To fill out the NC RoundPoint Mortgage Payoff Request Form, provide personal information, loan details, and any required signatures, ensuring that all fields are completed accurately.

What is the purpose of NC RoundPoint Mortgage Payoff Request Form?

The purpose of the NC RoundPoint Mortgage Payoff Request Form is to formally request the total amount needed to pay off the mortgage in full, which may include principal, interest, and any fees.

What information must be reported on NC RoundPoint Mortgage Payoff Request Form?

The information that must be reported on the NC RoundPoint Mortgage Payoff Request Form includes the borrower's name, property address, loan number, requested payoff date, and any necessary contact information.

Fill out your NC RoundPoint Mortgage Payoff Request Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Payoff Request Template is not the form you're looking for?Search for another form here.

Keywords relevant to payoff request form template

Related to blank mortgage payoff request form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.